Why use a mortgage broker?

Obtaining a mortgage can be a daunting task without a mortgage broker. With so many lenders to approach, different products to consider and of course hundreds of different mortgage brokers and advisers to choose from, knowing where to start can be tricky.

At Integrity Mortgage Solutions we specialise in finding a lender and mortgage that meets your needs. So read on to find out how a mortgage broker can benefit you in your search for a mortgage.

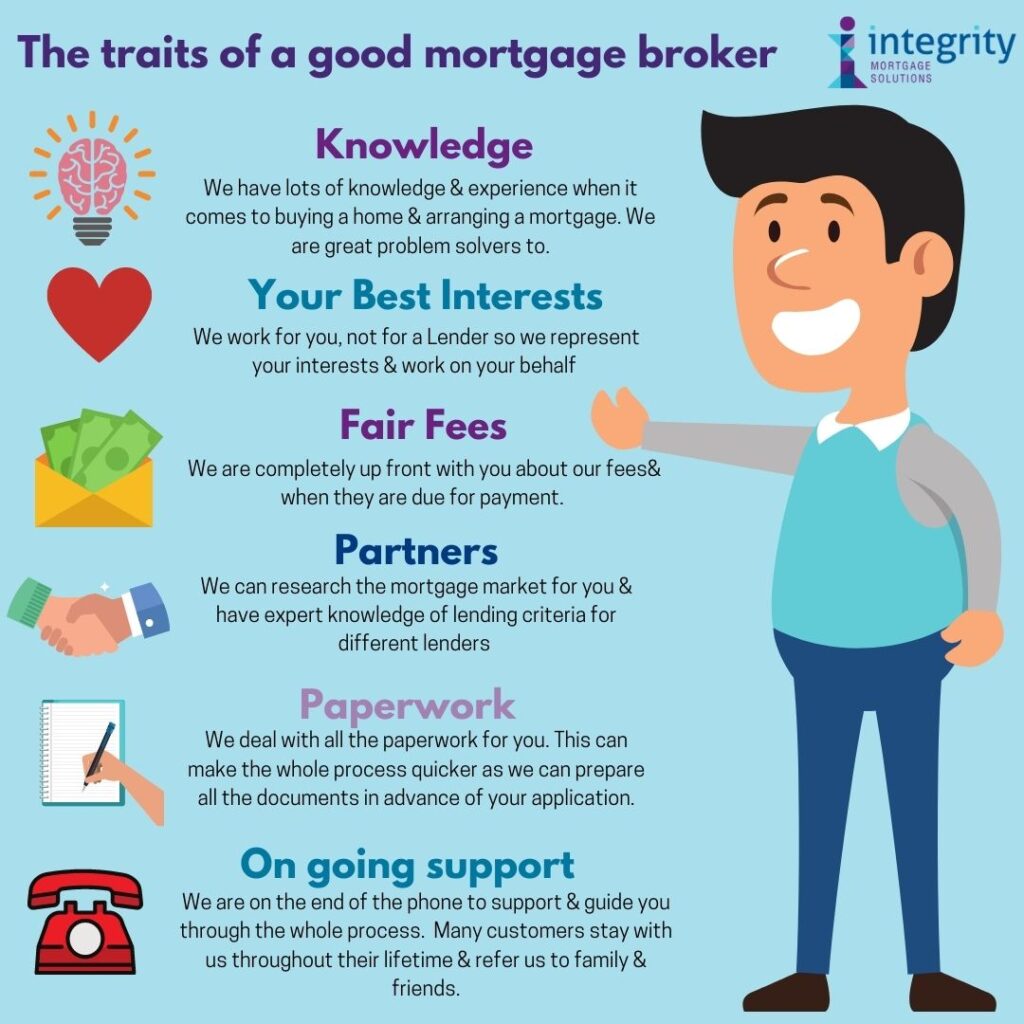

We work for you not for the lender

Get Independent and Impartial Advice on your options.

Integrity Mortgage Solutions are independent and are not tied to just one lender or a range of products. Your dedicated adviser will work for you to help you finance your home or property in the best way possible. We will research the market and find you the best rate in your specific circumstances and provide our recommendations to you, working with you to match a perfect product for your needs.

Knowledge & Experience

One of the benefits of using a mortgage broker is that we work with lenders, estate agents and solicitors day in day out! You may have had a mortgage application rejected by your bank but with out expert knowledge of lots of different lenders we can often find you a lender that fits your circumstance.

Time Saving

It can be time consuming talking to lots of lenders, waiting for answers and waiting for decisions. Not to mention, repeating your circumstances over and over again! However, you can talk to us and tell us everything just once and we do all the leg-work. This leaves you not having to fit calls and appointments in around your working hours and gives you more time for important things like family, friends or maybe even house-hunting!

Wider Choice of Mortgages

The mortgage market is huge! Mortgage brokers have tools that are far more complex than the online comparison sites to find you the best deal and have 1000s of mortgage deals to consider. In addition, some lenders also offer mortgage brokers exclusive deals that aren’t available on the high street. Many lenders don’t feature on mortgage pice comparison sites and many don’t submit all their mortgage products, plus you still won’t know whether you fit their lending criteria.

Negotiation Skills

Not everyone is comfortable negotiating mortgage directly with a bank. This can be more complex if an underwriter is involved in the decision making. This is an important part of our job and we are experts at presenting your circumstances to lenders to get an agreement in principle or mortgage offer for you.

We do all the paperwork

No one likes filling in forms! It’s part of our job to fill in application forms fully and accurately and check and compile all the documentation supporting your application. This means the lender has all the necessary documents and can speed up the process of getting you your mortgage offer.

Protection

Not everyone can be a mortgage broker! All our advisers are fully qualified to give advice holding CeMAP qualifications (Certificate in Mortgage Advice & Practice). Additionally, all advisers are held to account for their advice by our own compliance team that check every mortgage that we do. Plus, you have the protection of the FCA if you are unhappy with our advice.

Advice on other Mortgage Features

Rates are important and a small rate difference can add up substantially over the course of a mortgage, but there are other things you might not be aware of or need help with. For instance you might want to make overpayments to reduce your mortgage balance quicker or maybe you want to move house while still tied into a product with your current lender. All of these are things that we can advise you on.

Ongoing Support

The process of taking our a new mortgage or buying a home can be complex. A mortgage broker will offer you support, guidance and reassurance throughout the process. Likewise, you may have questions along the way and we are there to offer you that assistance. We also find that the majority of our customers rely on our services for their lifetime and trust us to help make ongoing decisions about their finances.

Life Insurance & Protection

Our advice doesn’t just stop with the mortgage! Above all, we have a duty of care to ensure you make good financial decisions. You might need life insurance or critical illness policy to. In short, we want you to start life in your new home with the right cover and protection in place that is suitable for you and your family.

Get in touch with an Integrity Mortgage Adviser

Our promise to you

It is important to us to offer you the best customer service and make the following pledges.

- Provide no-obligation consultation to discuss your needs, priorities & preferences

- We will always offer you impartial advice and take into account your personal circumstances when making a recommendation

- You will have one dedicated adviser who will work with you throughout your journey

- We will be honest and upfront about our fees.

- All our recommendations are reviewed by our compliance team to ensure we are giving you good advice

- We will respond promptly to your enquiries

- You will be kept informed of the progress of your mortgage application

Ask us anything

If you need help with your next mortgage get in touch for a free initial consultation.

Call us on 0116 239 5000

Thank you for reading our article, it is designed to provide general information and does not constitute advice.